Passive Income through Cryptocurrency is something people have started to explore more and more, as Cryptocurrency is the new black, and everyone from Indians to El Salvadorians are choosing it over traditional investment opportunities. Who doesn’t want to earn money by doing absolutely nothing? Read on to find out the ways to do precisely that.

Passive Income through Cryptocurrency- Staking

If you have ever opened a savings account in a bank, you know how cryptocurrency staking works. In layman’s terms, Staking means holding some cryptocurrency in your wallet and getting paid for it. If all of that sounds too good to be true, it isn’t. Here is why.

Once you have a stake in a cryptocurrency, your stake can then be selected to earn the right to validate the next blockchain at a regular interval. If you know anything about mining in the crypto market, you know that validating a block is the way to mine any cryptocurrency. The more cryptocurrency that you hold, the greater is your chance to validate the next block.

In this way, Staking works exactly like a bank account. The more money you have stored in a bank, the more benefits you get from the bank, and the higher are the interest rates. Staking is a very familiar concept applied to newer technology, and it works just as well for the benefit of the customer and the business.

You can stake your cryptocurrency at all the major coin exchanges, such as Binance and Kraken.

Passive Income through Cryptocurrency- Lending

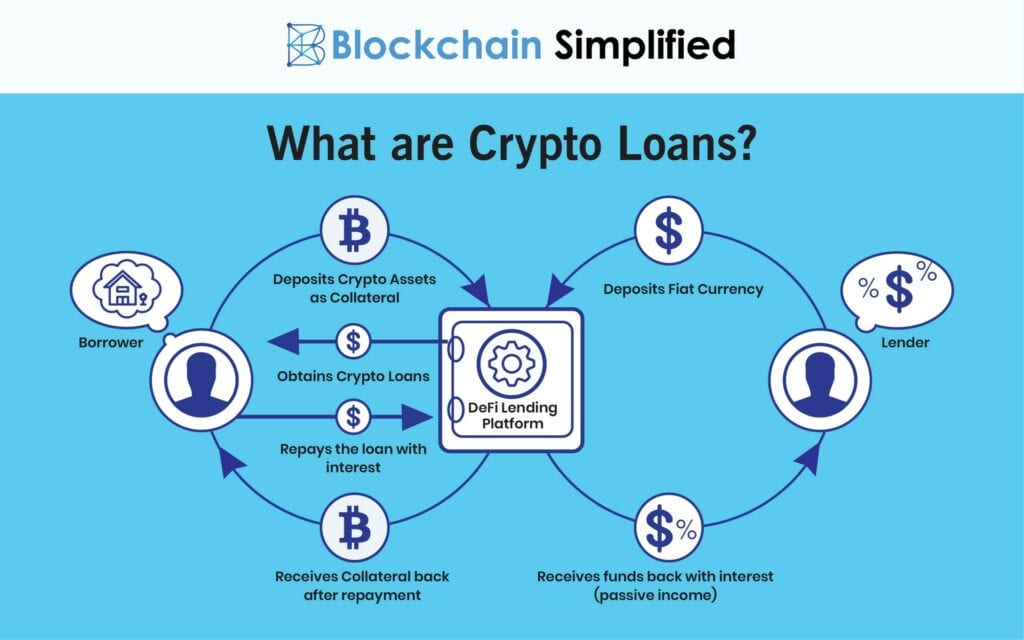

Another passive income method directly correlated to modern banking that most of us already know is loans. The difference between typical money lending and crypto lending is that cryptocurrency isn’t as centralised as banks, and crypto-assets are owned mainly by individuals and companies.

So, you can allow centralised financed banks such as Nexo, CelSius, and BlockFi to hold and lend your money to various benefactors for a set interest rate.

“At the core of crypto lending is a fairly simple concept: Borrowers are able to use their crypto assets as collateral to obtain a fiat or stablecoin loan, while lenders provide the assets required for the loan at an agreed-upon interest rate.”- Cointelegraph.com

Most centralised crypto-lending platforms offer a standard 8% rate on stablecoin lending, which is much higher than the 1% lending rate on the dollar. The only thing to watch out for is the market’s volatility, which is easily offset by centralised platforms.

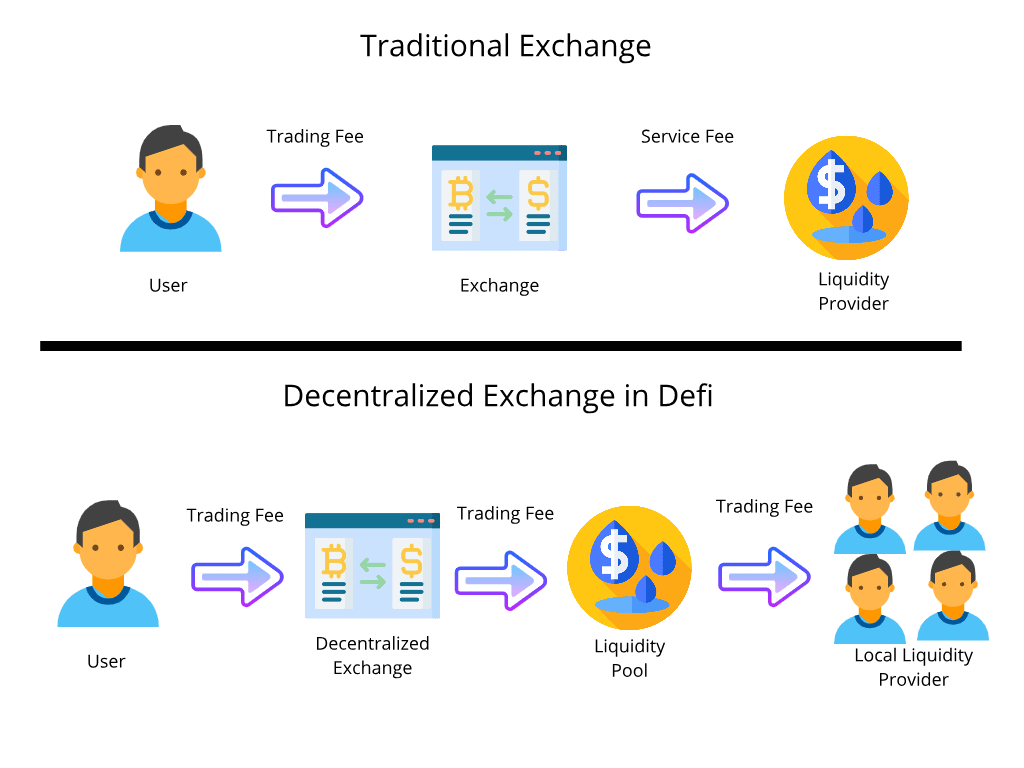

Passive Income through Cryptocurrency- Liquidity Mining

Liquidity Mining is a concept quite simple to grasp- you provide the liquidity or capital to decentralised exchanges(DEXs). In return, you get a portion of the trading fee whenever someone trades using the decentralised exchange. Easy enough?

The liquidity provider profits by getting a steady trading fee as a reward. The decentralised exchange gets more capital by using the funds from a provider. The exchange user gets to trade using cryptocurrency for much lesser fees than a centralised exchange. It is, as some would call it, a win-win-win.

Read More- Is the Viral NFT Trend already Dead in the Water?

However, keep in mind that liquidity mining is a very long term strategy, as the tokens you receive every day are pretty low in value. Still, it is easy money and a relatively new concept that you can take advantage of.

There are other ways to earn crypto passively, such as using the Brave browser, which grants you some coins for just searching up things and playing play-to-earn crypto games, like Gala Games. Still, I hope you learned something new from this list and can apply this to earn some Crypto-Capital.