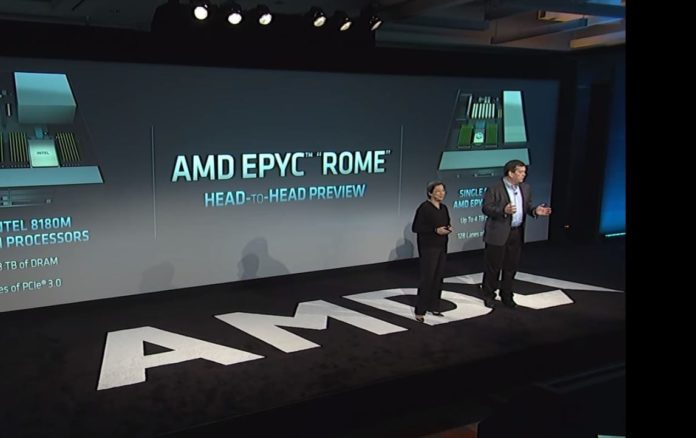

We talked about AMD’s soon-to-be-announced EPIC Rome 7742 a little while back. If those performance leaks are genuine, the 7742 is a truly impressive piece of server hardware. It’s sure to give Intel the sweats, something we didn’t think we’d ever have to say about AMD processors except in retrospectives pieces about CPUs from the early 2000s.

AMD’s starting from practically nothing in the server market, though. Their 2018 Q1 market share was a paltry 1.0 percent. Intel, in other words, had an objective monopoly in the server market. While AMD’s current 2.9 percent market share remains small, that’s an almost 3x increase year on year. Analysts are predicting that this could go up to as much as 10 percent.

The stock market’s clearly happy with AMD finally getting its act together. As the server market share increases, AMD’s stock prices have also seen growth. Analysts over at Jeffries issued notes that called for a buy rating on AMD stock, targeting a future price of $40. This is well above the $29 dollars AMD shares are closing at today.

While the runaway success of Ryzen processors in the consumer CPU market attracts a lot of mindshare, it’s the server market where the real money’s to be made. Intel didn’t get ten times larger than team Red by selling Core processors to gamers. Their Xeon processors power most of the world’s cloud infrastructure: Everyone from Facebook to Twitter to Google is dependent on Intel server hardware. Any significant change in this segment would have massive implications.

Further Reading: